Wage and hour overtime calculation

Most nonexempt employees in California have a legal right to receive overtime wages when they work long hours1 The amount of overtime depends on the length of the employees shift and the number of days. The university expects units to ensure that all regular staff are paid at or above the minimum full-time rate of 31200 per year or 15 per hour.

Free Printable Employment Contract Sample Form Generic Sample In Overtime Agreement Template 10 Prof Nanny Contract Template Contract Jobs Contract Template

19 2022 Effective Jan.

. All hours worked over 40 in a workweek Under the 8 and 80 overtime system. Last Updated December 30 2021 The Colorado Overtime and Minimum Pay Standards Order COMPS Order is the source of key wage rights and responsibilities. Under the 40-hour workweek overtime plan.

All hours worked over eight in a day and 80 in a 14-day work period. This DOL-Timesheet does not handle items such as tips commissions bonuses deductions holiday pay pay for weekends shift differentials or pay for regular days of rest. Want to reverse the calculation.

The City of San Diegos Earned Sick Leave and Minimum Wage Ordinance San Diego Municipal Code SDMC Chapter 3 Article 9 Division 1 became effective on July 11 2016. An employer may pay a training wage for tipped employees 18 and over in the amount of 720 for the first 90 days if applying the tip credit of 40 or 1150 if not utilizing the tip credit. Overtime pay for work over 40 hours a week or 12 a day.

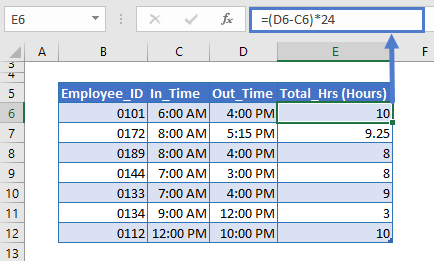

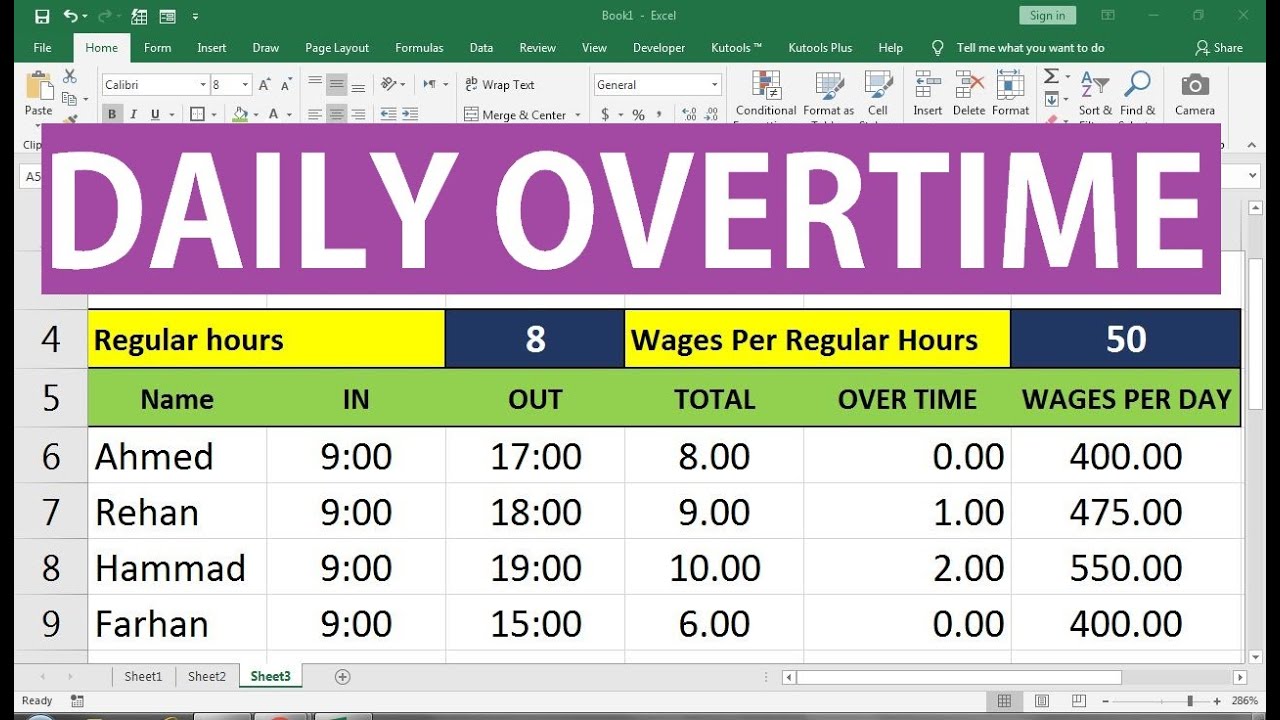

If an employee works 2 hours more than his decided limit the calculation will be as below. Wage Schedules As part of the University-wide Career Family Classification System units may develop pay ranges that support their compensation philosophy using labor market referenced data available through M-Pathways. Employers are not required to give employees pay raises unless the employee is paid minimum wage and the minimum wage is increased.

Minimum wage is the lowest pay rate that an employer is legally allowed to pay per hour. It is applicable to employees who perform at least two 2 hours of work in one. Alisha is hired by a California salon and gets a 1350 an hour wage.

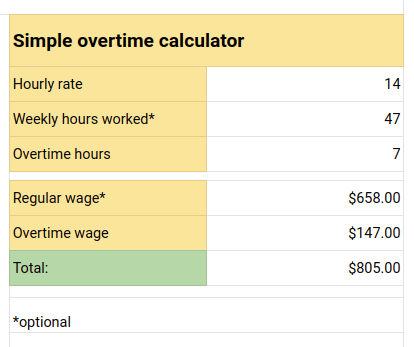

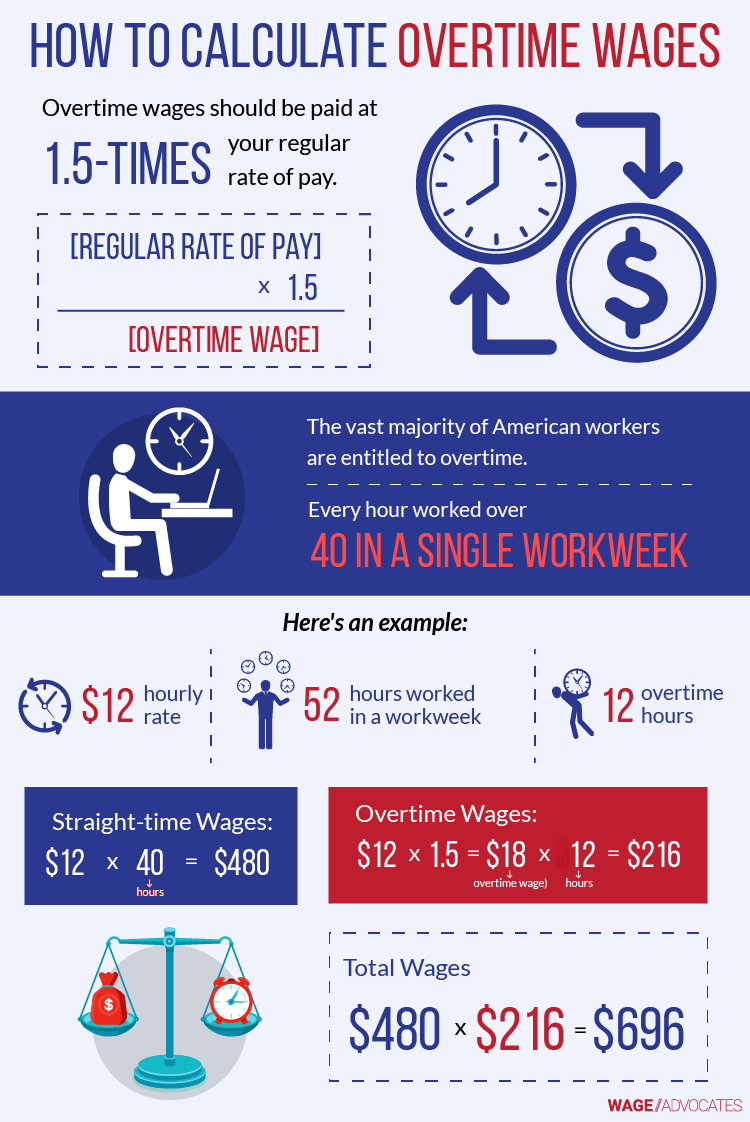

Overtime refers to the time worked by an employee over 40 hours per week. Regular rate the half-time premium. Out of approximately 120 million American workers nearly 50 million are exempt from overtime laws US Department of Labor Wage and Hour Division 1998.

Overtime on production bonuses bonuses designed as an incentive for increased production for each hour worked are computed differently from flat sum bonuses. Sections 541201-205 541207-208 541210. A living wage is the minimum a worker can be paid in order to afford to live in.

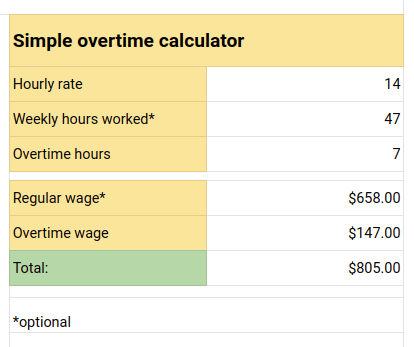

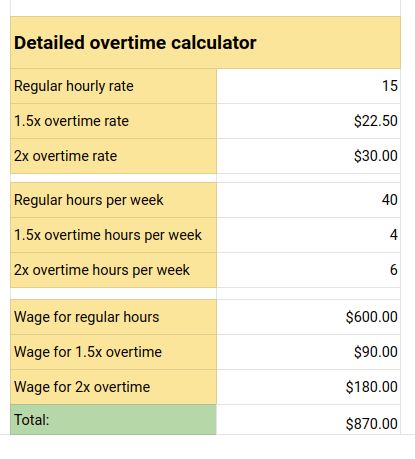

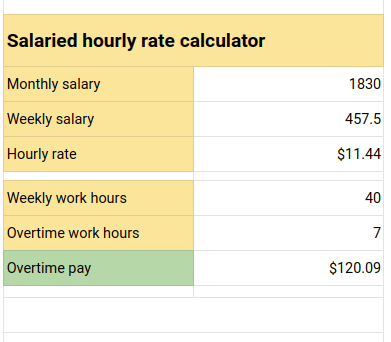

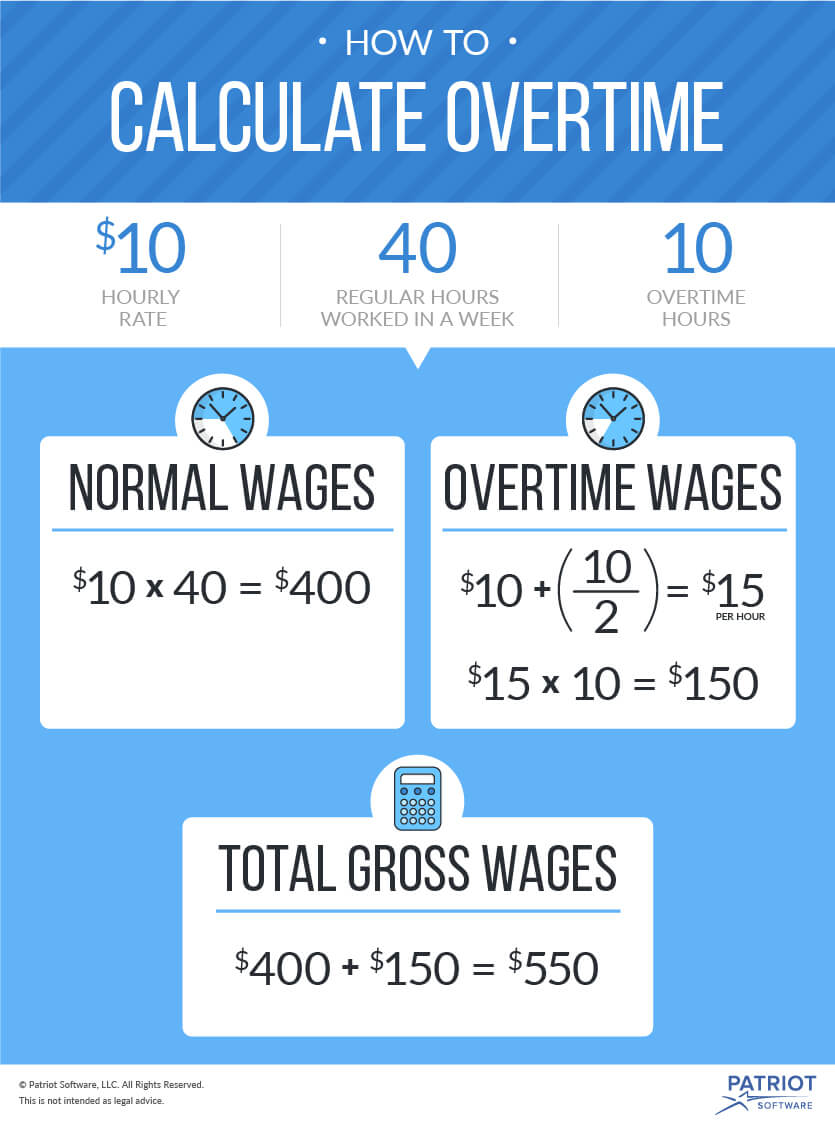

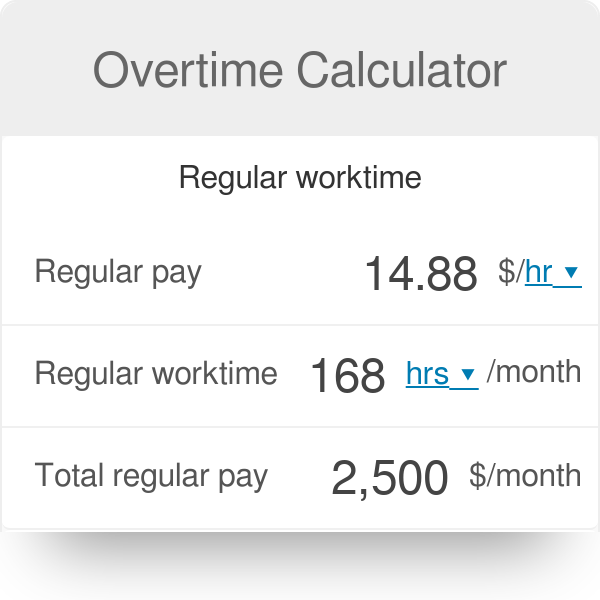

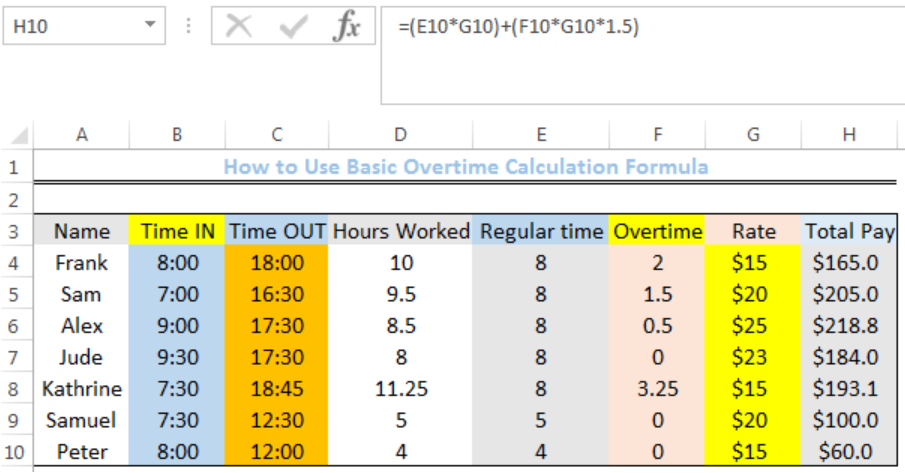

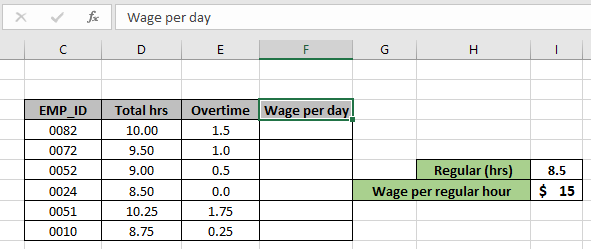

The agreed wage must be included in any overtime calculation when overtime-eligible employees work more than 40 hours per week. Use the following formula to calculate overtime pay for an hourly employee. Your yearly salary of 50000 is then equivalent to an average hourly wage of 25 per hour.

20Regular payhour X 15 X 2 hours 60 Overtime Pay. Overtime wages are a type of increased payment that employees can earn when they work more than a certain number of hours in a workday or workweek. Overtime Pay Regular pay X 15 X number of extra hours.

A Except as provided in section 4111031 of the Revised Code an employer shall pay an employee for overtime at a wage rate of one and one-half times the employees wage rate for hours worked in excess of forty hours in one workweek in the manner and methods provided in and subject to the exemptions of section 7 and section 13 of the Fair Labor Standards Act. Eligibility for the Colorado minimum wage. See Regulations 29 CFR 778101 and 778601.

See Regulations 29 CFR 778107. The calculation would be 38 hrs. As of 2021 salaried workers making 684 per week or more are exempt from overtime pay equivalent to 35568 per year.

According to The Fair Labor Standards Act FLSA most employees must be paid 15 times their regular working wage for any work above 40 hours per week. A week and the payment schedule is for weekly payments with a rate of 12 an hour. Meal and rest breaks.

And didnt work any overtime on the weekends you would have worked a total of 2080 hours over the 2022 year. Payroll Calculation for Salaried Workers. In some cases however employers must use a formula to calculate weighted overtime.

And rules on wage deductions on what work time must be paid and on. You can then convert your annual salary to an hourly wage of roughly 2404 per hour. It also includes overtime pay calculations at a rate of one and one-half times 15 the regular rate of pay for all hours you work over 40 in a workweek.

The activities constituting exempt work and non-exempt work shall be construed in the same manner as such terms are construed in the following regulations under the Fair Labor Standards Act effective as of the date of this order. After 90 days the rate must be increased to 1200 if not utilizing the tip credit. Overtime OT Rate.

Overtime on a flat sum bonus must then be paid at 15 times or 2 times this regular rate calculation for any overtime hour worked in the bonus-earning period. 3 The Commissioner of the Bureau of Labor and Industries has the same powers and duties in connection with a wage claim based on ORS 653010 to 653261 as the commissioner has under ORS 652310 to 652445 and in addition the commissioner may without the necessity of assignments of wage claims from employees initiate suits against employers. F Who is primarily engaged in duties that meet the test of the exemption.

1 week 12 per hour 146. For more information visit the Minimum WageOvertime Law page. Washingtons minimum wage increased to 1449 on Jan.

Under the payroll formula determine the total sum to be deducted and withheld. 1 2022 the Citys minimum wage will increase to 1500 per hour.

Overtime Pay Calculators

Overtime Pay Calculators

Overtime Pay Laws Every Small Business Owner Must Know

Overtime Calculator

How To Calculate Overtime Pay Youtube

Calculate Overtime In Excel Google Sheets Automate Excel

Overtime Pay Calculators

Overtime Calculation Formula In Excel Youtube

How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide

Fact Sheet 54 The Health Care Industry And Calculating Overtime Pay U S Department Of Labor

How To Calculate Overtime Pay A Short Guide Timecamp

Excel Formula Basic Overtime Calculation Formula

How To Calculate Overtime Pay From For Salary Employees Youtube

Gross Wages With Overtime Boom Cards Digital Task Cards Consumer Math Task Cards Digital Task Cards

Calculate Overtime Amount Using Excel Formula

Tick Tock Set Up Your Time Clock Time Clock Clock Tick Tock

Overtime Pitfalls That Could Cost You Daily Infographic Infographic Business Infographic Learn Something New Everyday